18+ Va home loan rates

The latest rate on a 71 ARM is 3946. For today Thursday September 15 2022 the national average 30-year VA mortgage APR is 5650 up compared to last weeks.

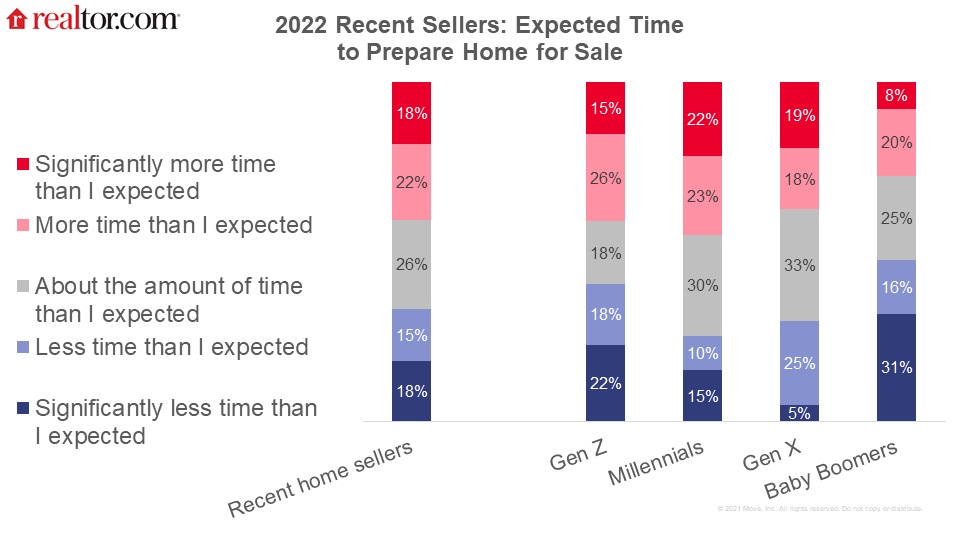

Generational Insights Realtor Com Economic Research

Va Mortgage Rates Cash Out Refinance - If you are looking for a way to reduce your expenses then our service can help you find a solution.

. VA Loans from PenFed. If you have a second mortgage on the home the holder must agree to make your new VA-backed loan the first mortgage. Dont Wait To Take Advantage.

Rates listed are for primary residence in single family home with a 0 down payment and borrower credit score of 740. But if youre able to make a down payment of 5 but less than 10 your. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Ad VA Mortgages from PenFed Credit Union. Ad Review 2022s Best VA Home Loans. According to a weekly survey of 100 lenders by.

The latest rate on a 101 ARM is 4039. Get Your Quote Today. Trusted VA Loan Lender of 300000 Veterans Nationwide.

APR is the all-in cost of your loan. Find Your Dream Home Today. On Thursday September 15th 2022 the average APR on a 30-year fixed-rate mortgage rose 2 basis points to 6104.

Va out refinance rates refinance mortgage. Skip the Bank Save. Rates for a 30-year fixed-rate conventional mortgage are currently at 6 while the interest rate for a 30-year fixed-rate VA loan is slight above 5.

Sep 12 2022 300 AM. Are You Eligible For The VA Loan. Lower Credit And No Down Payment.

Peter Warden Military VA Loan contributor. In many cases youll have the option to roll the VA funding fee into your loan. Todays rate on a 30-year fixed VA loan is 540 compared to the rate a week before of 530.

Check Your Eligibility for a 0 Down VA Loan. With todays interest rate of. Ranking Criteria Trusted by Over 45000000.

LendingTree Helps Simplify Financial Decisions Through Choice Education and Support. About Home Loans. For your first VA loan youll pay a 23 funding fee.

After all those with low credit scores generally enjoy the same. APR Annual Percentage Rate is. The average APR on a 15-year fixed-rate mortgage.

The annual percentage rate APR on a 30-year fixed-rate mortgage is 565. For subsequent applications youre looking at a 36 fee. The typical funding fee ranges from 14 to 360 of the loan amount.

Current VA Mortgage Rates September 2022. Ad Use Our Comparison Site Find Out Which Lender Suits You Best. VA Loans Are Often The Best Mortgage Option A Veteran Can Get.

Lock In Your Low Rate Today. Ad Thank You For Your Service. Though it briefly dipped below 5 in early August the average 30-year fixed mortgage rate is now back up to 589 the highest its been since.

As part of our mission to serve you we provide a home loan. VA Loans from PenFed. The 52-week high rate for a VA fixed mortgage rate was 543 and the 52.

Ad VA Mortgages from PenFed Credit Union. 8 report puts that same weekly average for conventional 30-year fixed-rate mortgages at 589 with 07 fees and points up from the previous weeks 566. The APR was 547 last week.

Ad Calculate and See How Much You Can Afford. Low Interest Online Lenders Comparison Reviews Top Brands Free Online Offer. Find Your Dream Home Today.

According to a VA loan APR survey the national average for a 30-year loan was. Ad Make Lenders Compete and Choose Your Preferred Rate. Moneys daily mortgage rates reflect what a borrower with a 20 down payment.

Mortgage loan can be refinanced. Todays national VA mortgage rate trends. Veterans United Home Loans.

For people with poor credit especially the low interest rates offered through the VA home loan program are very enticing. You will need a COE. You can use our VA eligibility tool or call a loan officer at 800-531-0341 to discuss your specific.

A full percentage point. We offer VA home loan programs to help you buy build or improve a home or refinance your current home loanincluding a VA direct loan and 3 VA-backed loans. If youre eligible for a VA loan it may be the right option for you.

VA helps Servicemembers Veterans and eligible surviving spouses become homeowners. Offer valid for refinancing of VA home loans only. Start By Checking The Requirements.

A year ago a buyer who put 20 down on a median priced 390000 home and financed the rest with a 30-year fixed-rate mortgage at an average interest rate of 288 had. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Generational Insights Realtor Com Economic Research

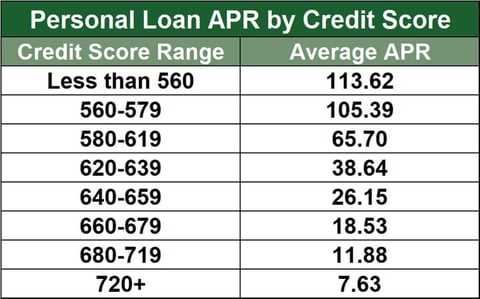

16 Best Interest Rates For Bad Credit 2022 Badcredit Org

Why The New Inflation Report Is Sending Stocks Higher

/cdn.vox-cdn.com/uploads/chorus_asset/file/23467827/5_14_22_rogers_baseball_savant_pitching_illustrations.jpg)

Mlb Game Preview Fan Chat Marlins Vs Brewers May 14 2022 Fish Stripes

Gen Z Realtor Com Economic Research

2

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/23935826/Broja.png)

Scouting All The Strikers Everton Have Been Linked With Broja Adams Gyokeres Guirassy Kalajdzic Ajorque Moffi Royal Blue Mersey

Appraisals Check The Water Source Appraisal Today

Generational Insights Realtor Com Economic Research

Kenita Tang Property Group Home Facebook

Fha Single Family Mortgages In Connecticut Can Have Down Payments As Little As 3 In Some Cases Fha Insurance Allows H Home Buying Home Ownership Real Estate

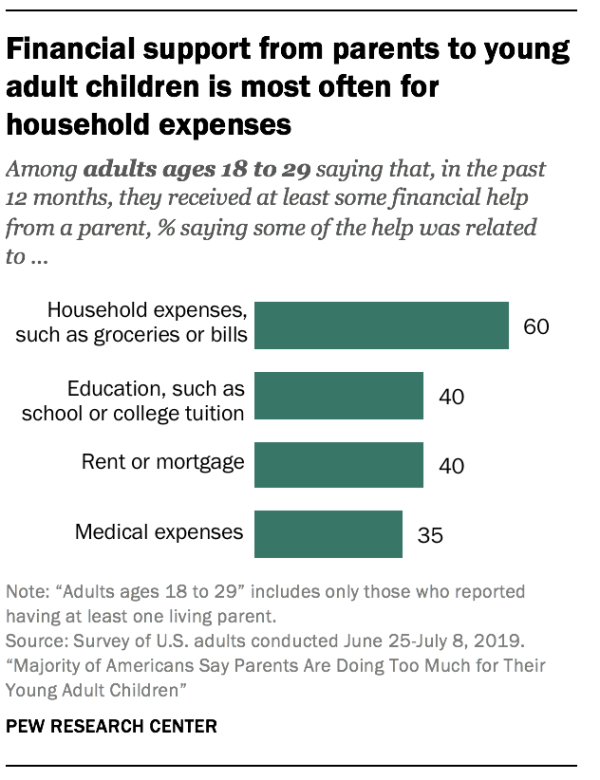

Only 24 Of Young Adults Are Financially Independent By 22 Per Pew

Appraisal Waivers Almost 50 Of Fannie Freddie Loans Appraisal Today

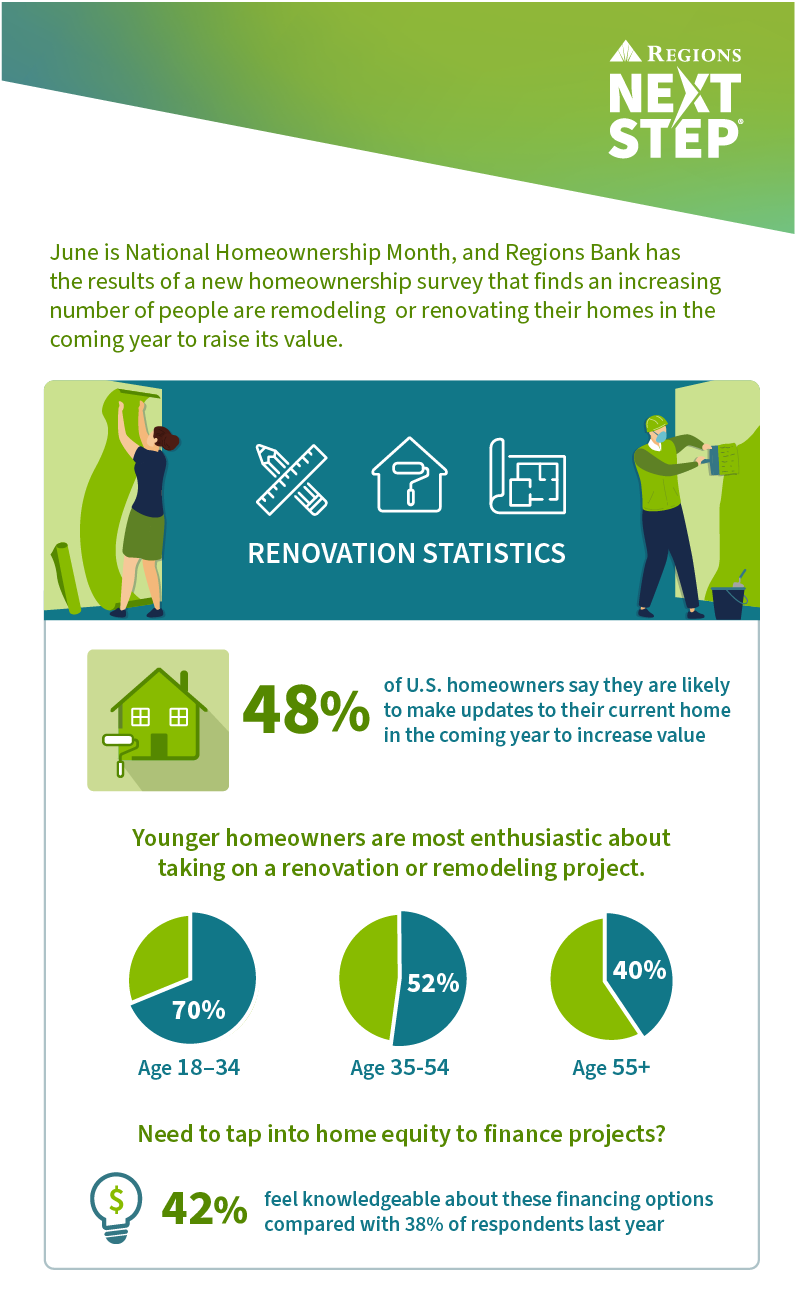

Csrwire Regions Next Step Survey Finds Americans Are Increasingly Prioritizing Renovations To Boost Home Value

Csrwire Regions Next Step Survey Finds Americans Are Increasingly Prioritizing Renovations To Boost Home Value

Dutrac Community Credit Union Dutrac Cu Twitter

Generational Insights Realtor Com Economic Research